OVERVIEW

Our system of procedures that governs Arcapita’s management and operations is fundamental to our future success. Our different governing structures that have been put in place are committed to an efficient, entrepreneurial decision-making structure that is fair, transparent and accountable.

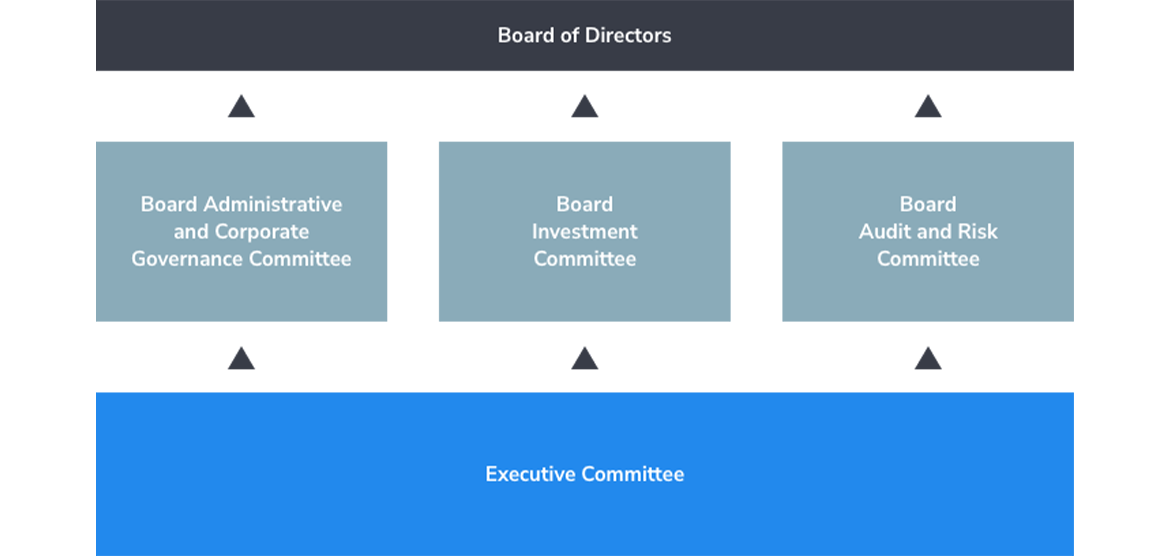

Board Committees

Our Board of Directors is assisted in its monitoring and oversight responsibilities by the following Board committees:

Board Administrative and Corporate Governance Committee

The primary duties and responsibilities are to:

- Approving and recommending corporate and administrative policies and procedures

- Reviewing and recommending approval of the annual budget

- Recommending and revising corporate governance policies and procedures

- Overseeing and monitoring the governance framework

Board Investment Committee

The primary duties and responsibilities are to:

- Establishing operating guidelines for investment activities

- Approving new investments and exits

- Monitoring investment performance

- Approving financing and issuing of securities

Board Audit and Risk Committee

The primary duties and responsibilities are to:

- Approving and recommending for further approval by the Board of Directors:

- Annual financial statements and budgets

- Auditors and consultants

- Monitor financial reporting, risk, compliance and internal control

- Reviewing and appraising activities of external and internal auditors

Shari’ah Supervisory Board

Our Shari’ah Supervisory Board ensures that all investments undertaken by the investment teams comply with Shari’ah principles. Our Shari’ah Supervisory Board also approves the audited financial statements of Arcapita, confirming adherence to Shari’ah principles.

Management Committees

We have assembled a management team with extensive experience in building and managing investment platforms globally. Drawing upon its collective experience and track record, Arcapita enjoys a seasoned management team with experience spanning multiple economic cycles.

Executive Committee (ExCo)

ExCo oversees the strategic planning for Arcapita and the decision making for all new investments. For example, prior to making a commitment to sign definitive agreements relating to investments (equity and financing), each new investment will need to be reviewed by ExCo. The committee’s duties and responsibilities include:

- Setting global strategy for Arcapita

- Reviewing and recommending new investments

- Reviewing and approving business plans, budgets and control systems

- Managing human capital, including determining compensation and benefits plans and overseeing human resource development

- Evaluate the marketability of investment products identified by the investment teams

Management Administrative Committee (MAC)

The MAC has been established to provide a broad range of input to the ExCo related to Arcapita’s business. These include:

- Reviewing current year budget process and proposed updates and tactical adjustments

- Reviewing near-term and mid term business strategies amidst the changing business landscape

- Staff development and employee morale

Management Investment Committee (MIC)

MIC oversees the management of the existing investment portfolio, reviews all investment and services decisions of Arcapita. MIC’s role and responsibilities include:

- Overseeing all investment teams and investment assets

- Vetting all investment opportunities for ExCo approval

- Serving as first point of contact for individiual investment teams

- Serving as go-to liason for new deal activities for specific sectors and geographies

- Managing the Firm’s reporting relating to investments (e.g., quarterly reviews, valuation updates, dividend distributions, investor reporting etc)

- Providing periodic portfolio summary input for Arcapita’s overall financial reports

Management Risk and Audit Committee (MRAC)

MRC’s duty is to establish and maintain a risk management culture and framework throughout Arcapita to best manage Arcapita’s shareholder and client interests. Its mandate is to identify, assess and measure risks arising from the Firm’s activities, and to define the appropriate course of action to mitigate or manage them. MRC’s role and responsibilities include:

- Establishing and maintaining a risk management framework for Arcapita by working with BAC

- Overseeing risk functions

- Ensure proper audit oversight and prompt issue resolution